Zavo revolutionizes EMI Culture, rewards timely payments with prizes worth ₹75 lakh

Aug 28, 2025

VMPL

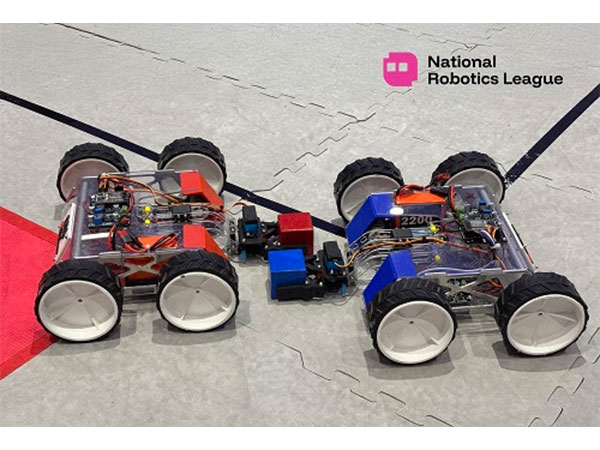

New Delhi [India], August 28: Zavo's India's largest community of EMI payers, today announced the launch of EMI Game--a competitive repayment league where borrowers are rewarded for timely payments with prizes worth up to ₹75 lakh.

Billed as the world's first repayment-based game, EMI Game transforms the monthly chore of loan repayment into a contest where discipline is rewarded. Users will likely win anything, such as an iPhone 16 Pro Max, superbikes, gaming consoles, vouchers, and an electric car for timely credit repayments.

"Every month, Indians pay over 50 crore EMIs, adding up to more than ₹1.25 lakh crore. The relationship between borrowers and banks has traditionally favored banks, with penalties and damaged credit scores for missed EMIs. EMI game aims to change this by celebrating timely repayments. It's India's first repayment league--legal, transparent, and designed to transform the repayment culture, as noted by Kundan Shahi, CEO of Zavo.

The platform allows repayments from any bank, app, or method--UPI AutoPay, NACH, net banking, cards, or cash. Each repayment earns points, and players climb a leaderboard that resembles a cricket points table. Maintaining a streak over six months qualifies participants for the biggest prizes, while every borrower earns some reward.

India's retail credit market has surged past ₹50 lakh crore, driven by younger borrowers. Yet surveys reveal disillusionment: 78% of Gen Z borrowers say they would pay faster if rewards were involved, while 67% find repayment tedious and thankless. EMI Game is designed for this demographic--gamifying repayment and making discipline something to brag about.

Zavo frames it as a cricket-style contest by turning a dull, thankless defensive innings of personal finance into an IPL-style run chase where every on-time payment is a boundary and every early payment is a six.

The format also benefits lenders, who stand to gain from lower defaults, better repayment rates, and stronger customer loyalty. Borrowers, meanwhile, get motivation, improved credit profiles, and a shot at tangible prizes. Significantly, Zavo does not alter loan terms or collect repayments; users pay lenders directly, and Zavo verifies the proof before awarding points.

Backed by consumer brands, the prize pool is designed to sustain excitement. Players can track Zavo is redefining collections for its community member by putting borrowers at the center of recovery. Instead of facing pressure, harassment, or repeated calls after a default, customers get a safe and transparent platform to clear their dues.

Each repayment comes with cashback and rewards, turning recovery into a positive experience. By enabling borrower-led repayment rather than lender-led chasing, Zavo is proving that even defaults can be resolved with dignity and trust, a model that is fast emerging as an alternative to traditional collection practices. Founded in 2025 by Kundan Shahi, Zavo has quickly grown into India's first and largest EMI payers' community with over 1 million users.

By combining behavioral AI nudges with gamified tools like EMI Challenges, EMI Game, and Zavo Coins, the platform helps Indians save money, avoid debt traps, and strengthen their credit health

https://zavo.go.link/kt3Yl

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same)